Top 5 Money Management Tips

If you are a Forex trader, money management is something that you need to be extremely familiar with. This is what we are here for today. We are about to provide you with the top 5 Forex money management tips out there, so you can start making real money and stop losing cash.

Always Examine Fundamental News

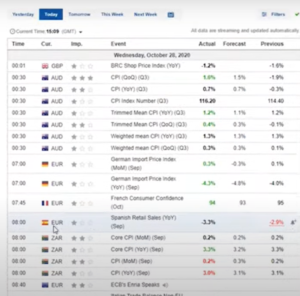

When it comes to money management for Forex trading, one of the most important things that you need to do is to keep fundamental news in mind. When it comes to fundamental news, what you really need to look out for is 3 Bull News.

To check for 3 Bull News, simply go to the economic calendar on investing.com, and take a look at the fundamental news. Remember folks, you really don’t want to trade with any currencies that are showing 3 Bull News. Always protect your profits and close positions that involve Forex pairings or currencies with 3 Bull News in the forecast.

Never open any new positions with any currencies that have 3 Bull News in the forecast. This kind of news creates big time swings and volatility, and this makes trends and price directions super hard to anticipate. Always wait until well after a 3 Bull News rating is over to start trading with that particular currency.

Never Add to a Losing Position

When it comes to proper money management in Forex trading, one of the biggest mistakes that newbies often make is to add to a losing position. In other words, many people will see that their trade is losing, but also think that it could turn around in the near future, and therefore, to keep that position alive, will add more money into it.

Folks, in terms of money management, this is a fatal error, one that needs to be avoided at all costs. For one, if your position is losing, it means that your initial analysis probably was not on point, so adding more money into that same position, based off of that same bad info or analysis is probably not going to pan out. Although there is a chance that the trade may turn around after you add more money into it, the chances of this occurring are fairly slim. Doing this is never a good idea.

If you have a losing position, it’s best to just cut your losses. Save whatever money hasn’t been lost yet, and then open new positions from scratch, based off of proper analysis. Now, you can always try looking at a larger timeframe to see if there is a good chance of things turning around, so you can at least break even. However, that said, either way, adding more cash into a currently losing position is not recommended.

Monitor Price Action at Larger Timeframes

For proper Forex money management, related to the last tip, you should always monitor price action at the larger timeframes. Keeping the daily timeframes in mind will let you know if there is strong resistance or support at a certain price point. A good idea is to turn on alerts so you will get alerts when the price of a currency or pairing hits a certain price point.

This works for potential trades that are not open yet, as well as for current open positions. If you monitor price action at larger timeframes, you can get a good idea of what direction the price will move in the future. It’s a good way to tell if trades need to be closed, or if it is best to keep them open.

Cut Your Losses Early

The fourth Forex money management tip that you need to follow at all times is to always cut your losses early. Simply put, there is no real point in holding onto losing positions. For example, for a buy trade, if you see that candlesticks are breaking through support levels on higher timeframes, it’s a sign that the price is going to go south, so cut your losses early. Now, this is true even if you currently have a winning position, but you see that things might turn around in the other direction soon.

Instead of holding onto a winning position to the point where it turns around and starts costing you money, walk away with the profits that you do have. Sure, big profits are better than small profits, but small profits are also better than losses. Moreover, the simple fact of the matter is that sometimes you have to accept a loss, even just a partial loss. If you see things not going your way, it’s better to lose $100 than $1,000.

Let Winning Trades Run

The fifth and final Forex money management tip that we want to provide you with here today is to let your winning trades run. If you have a winning position that is in the profit, and you can clearly see that the position should still increase your profits, then leave that position open.

Once again, always take a look at the larger timeframes to see what the trend and price action is like. Now, there are of course various ways of analyzing the market to see what direction the price is going to move in. Use 1 and 4 hour timeframes, as well as daily timeframes, check your support and resistance areas, and figure out whether or not the price should keep trending in the same direction, or if there is a turnaround in the near future.

If all signs point towards your open position continuing in the same direction and continuing to profit, then keep that position open. There is no point in closing a position that is going to keep increasing in value.

Forex Money Management – Final Thoughts

People, the 5 above Forex money management tips that we have provided you with are absolutely essential to follow. If you follow these tips, cutting your losses and increasing profits becomes second nature.

Now, if you really want to learn everything that there is to know about Forex trading, we would strongly recommend joining the Income Mentor Box Day Trading Academy.