The Truth of Copy Trading

When it comes to trading as a newbie, something you might be interested in is copy trading. The fact of the matter is that trading is of course not an easy thing, and this is the case whether you are trading Forex, stocks, or anything in between. It takes a lot of time and effort to trade, especially if you plan on being profitable.

This is the reason why so many people turn to copy trading, as it appears to me a much faster, easier, and simpler way to trade. Of course, if you manage to find a good way to engage in copy trading, you can be quite profitable. However, copy trading is not as easy as you might think, and as opposed to what some say, it involves more than simply copy and pasting signals into your broker or trading platform.

You need to understand what you are doing, you need to find the right people to copy trades from, and you need to trust them. To help you out, today we want to go over 5 very important tips to help you be successful with copy trading.

What is Copy Trading?

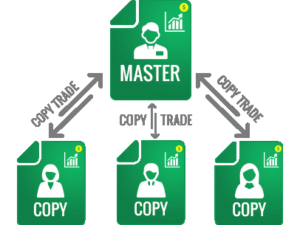

In theory, copy trading is a very simple thing. In its most basic form, copy trading involves 2 people, the master trader or leader, and the follow or the copy trader. The master or leader places his or her trades, and as soon as they do, the follower then copies those trades as if they were their own. Sounds simple enough right? Yes, it is actually quite simple, but of course, there are some issues that copy trading comes with.

The Difficulties of Copy Trading

Ok, so although copy trading is technically very simple. You find someone who knows what they are doing and is profitable, then you follow them and copy their trades. In theory, this is quite simple. However, there is one obvious problem here, which is of course that you have to copy the right trades and follow the right master trader.

Sure, copy trading may in theory be simple, but if you don’t follow the right person, you will just end up losing money. Simply put, it is totally possible for you to follow a trader that really doesn’t know what they are doing, and therefore you may end up copying bad trades that will result in losses.

4 Tricks for Successful Copy Trading

Alright, so now that you know exactly what copy trading is, as well as what the difficulties of it are, we can provide you with some tips to help ensure your success. Let’s get right to it!

Understanding the Trader’s Strategy

The first piece of advice that we can give you here is that you absolutely need to be familiar with what the trader in question is doing. Simply put, although you are just copying trades, you do need to know why those trades were placed, and what the reason behind those trades are.

For instance, if the person you are copying trades from is using a trend following strategy, then you also need to be familiar with trend following strategies.

The reason for this is because if you end up losing a few trades, you might be tempted to say that the master trader’s strategy is bogus and doesn’t work, even if it actually does. The bottom line is that although you are just copying another trader, you still need to understand the underlying strategies and methods.

Knowing the Trading Leader

Moreover, when it comes to copy trading, finding the right leader is essential. You need to know and trust the person who you are copying the trades from. For example, this is just like a business. Sometimes you get people that don’t know what they are doing, yet due to their charisma, personality, or good looks, are the face of the company, the person that other people listen to.

Well, this can be the same in trading. You might follow somebody because they talk the talk, but do they walk the walk? The person who you are copying from needs to be trustworthy, full of integrity, and you need to be able to trust their every move. Therefore, finding a good master trader that is more than just talk is essential.

Find a Leader That Has a Stake in Trading

Yet another tip for copy trading that you need to follow is not only to find a leader that you can trust, but one that has something to lose. Simply put, people who have something to lose always do their best to ensure that they don’t lose. This is opposed to somebody who has no real stake in trading and has nothing to lose.

These people, although they may seem like good choices, will end up executing risky and dangerous trades that are prone to losses.

Those people don’t care if they lose, and they certainly don’t care if you lose. Therefore, finding a master trader that has a stake in the game is a big deal. If the master trader has something to lose, they will do their best to win every single trade, and those are the people you want to be copying from.

Diversify

The final tip here for copy trading is that no one is saying that you only need to follow a single person, a single master. One master might like trading this way, and another might like trading that way. In other words, just like with stock investing, to keep your money safe, you want to diversify.

Whether you are diversifying your stocks or the master whom you copy trades from, diversification is key. In case one master trader doesn’t perform well in a certain market condition, you can always turn to another master that performs better in those same conditions.

Copy Trading Tips – Conclusion

The bottom line is that while copy trading can be very profitable, but you do need to find the right masters, you want a few of them, and you need to understand what they are doing.