Crude Oil Trading Tips For Success

OFFICIAL SITE: INCOMEMENTORBOX.COM

If you are looking for some great crude oil trading tips to help put money in your pocket, you have come to the right place. Oil is a big part of modern life, especially because our vehicles run on it, planes fly with it, and a massive portion of consumer goods are made with it. This is why oil is such a sought after commodity, because it is used for literally everything, and this is why it is worth so much.

The world literally runs on oil and it’s the cause of many wars. That said, trading and investing in crude oil can be and is very profitable for many, but it does need to be done the right way. Today we are here to go over some of the most valuable crude oil trading tips you will ever encounter. These crude oil trading tips can help make the difference between money gained and money lost.

Why Trade in Crude Oil?

You might be wondering why exactly you would trade in crude oil or require crude oil trading tips. Well, let us tell you exactly why. Well, for one reason, crude oil generates nearly $90 trillion dollars US per year in GDP for countries around the world, and it makes up something like 3% of the global economy on an annual basis. This is a ridiculous number, a massive number indeed.

There is a whole lot of liquidity in this high value market and it makes it perfect for trading and investing in. Oil is in super high demand, and a high demand, coupled with limited supply, means that oil tends to be worth a lot, and therefore makes for a great investment opportunity.

Oil has tight spreads, clear chart patterns, is very liquid, and has tons of money floating around in the market. The bottom line is that crude oil is in demand, it’s worth a lot, and prices fluctuate constantly. With the right crude oil trading tips, you can indeed make a killing trading this particular commodity.

Crude Oil Trading Tips – Factors that Affect Price Movements

When it comes to crude oil trading tips, something you definitely need to know about is what affects crude oil price movement. There are many varying factors that can cause increases or decreases in crude oil values, and being familiar with these factors is crucial to your success.

Factors that Affect Crude Oil Supply

- Maintenance & Outages – One thing which can affect the supply of oil is the monitoring, maintenance, and conditions that affect various refineries and transportation methods. For instance, war in the middle east always leads to a big concern on the supply of oil. War often causes a decrease in supply, which then causes a spike in oil prices.

- OPEC & Oil Suppliers – When it comes to crude oil trading tips, in terms of what affects the supply of it, OPEC is a big player. This is a global oil cartel which has a massive say over global oil prices and supply. For instance, OPEC and other oil suppliers may choose to limit global supply, which then causes a price spike.

Factors that Affect Crude Oil Demand

- Oil Consumers – When it comes to the demand of crude oil and the price related to demand, oil consuming countries have a big say in what goes on here. For instance, if countries plan on decreasing their use of fossil fuels, say by instituting a law that only electric cars can be used, this will decrease the demand for oil, and therefore cause a drop in prices.

- Seasonality – Another factor that can affect the demand for crude oil is seasonality. For instance, if a country suffers an extremely cold winter, it means that people living there will consume more oil to heat their homes, this increasing demand and therefore increasing the price of crude oil.

Crude Oil Trading Tips

Let’s quickly go over some really valuable crude oil trading tips, so you can get started in this market and make some real money. Generally speaking, crude oil trading will follow a pretty precise strategy. There are of course many different crude oil trading tips and strategies out there, but one thing they all have in common is a high level of risk management.

For example, a great crude oil trading strategy may include three main factors, these being fundamental analysis, technical analysis, and risk management. In terms of crude oil trading tips, what you need to understand first are the fundamental basics surrounding supply and demand. Here, you can look for entries into the oil market using technical analysis, or in other words, using various charting and indicator based trading strategies.

Then, when you have identified a buy or sell signal that can produce profits, you then need to engage in proper risk management to minimize losses and maximize gains. As an example, during 2017, OPEC agreed to limit oil production and therefore decrease supply, which as fundamental analysis dictates, should increase prices, which then needs to be factored into a trading strategy.

Something else to keep in mind when it comes to crude oil trading tips is that technically speaking, it can be traded in various ways, something else you should be familiar with. Crude oil can be directly invested in via individual markets, you can trade via futures and options, and you can engage in CFTC or speculative trading as well. Each type of investing has certain benefits and drawbacks to be familiar with.

Crude Oil Trading Tips – Paying Attention To Reports

The final thing we want to say today in terms of crude oil trading tips is that there are two main reports to pay attention to, which include the API or American Petroleum Institute and the DoE or Department of Energy.

ACCESS FREE CRYPTOCURRENCY MENTOR BOX SIGNALS BELOW!

Crude Oil Trading Tips – Final Thoughts

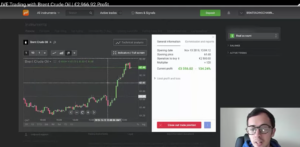

Today we have provided some great crude oil trading tips, but keep in mind that you do still need to develop a specific crude oil trading strategy to see gains. We would recommend watching the crude oil trading tips video we have included here. If you want to learn about indicators, charting, and trading strategies so you can make money in this market, we would absolutely recommend joining our Income Mentor Box Day Trading Academy.